Investment objective

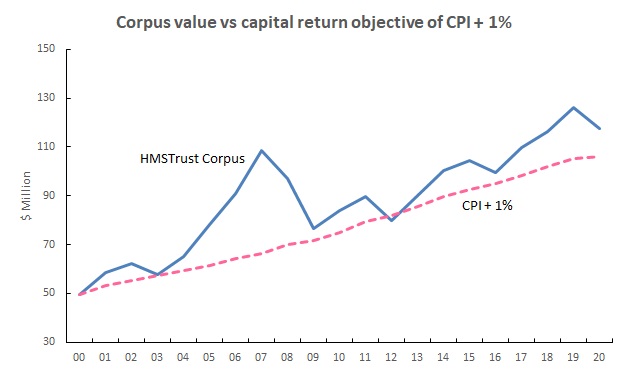

The objectives of HMSTrust’s investment mission are twofold: firstly to achieve long-term appreciation of the value of the corpus, ahead of inflation, and secondly to generate sufficient income to fund the annual grant giving program and operating expenses. Long-term growth in the value of the corpus is essential if HMSTrust is to continue to serve Victoria’s communities in perpetuity.

HMSTrust’s overall investment objective is to achieve a total investment return of Consumer Price Index (CPI) + 5.5% over rolling 20-year periods. Of the total expected annual investment return, long term capital returns are targeted at CPI + 1.0% p.a. and income returns are targeted at 4.5% p.a. to cover granting and operating expenses.

Responsible investment

HMSTrust aims to support positive social and environmental long-term outcomes in the state of Victoria. To avoid circumstances where HMSTrust’s investment activities are working against the objectives of HMSTrust’s granting activities, HMSTrust has a principles based responsible investment policy that aims to balance responsible investment with the need to maintain its granting capacity.

The corpus currently has two impact investments. The investment in the Murray Darling Basin Balanced Water Fund, in addition to earning financial returns, also undertakes watering events across wetlands and funds the development of infrastructure which enables the sustainability of water delivery to wetlands. Our investment in the COMPASS Social Impact Bond seeks to improve outcomes for young Victorians transitioning from care to independent living.

In FY20, the corpus’s large capitalisation developed market exposure was switched into a product that screens out further investments that are not aligned with HMSTrust’s vision, purpose and granting strategy. In addition to screening out companies involved in tobacco production and weapon manufacture, companies involved in fossil fuels, alcohol, gambling, adult entertainment, and conduct-related controversies are now also screened out.

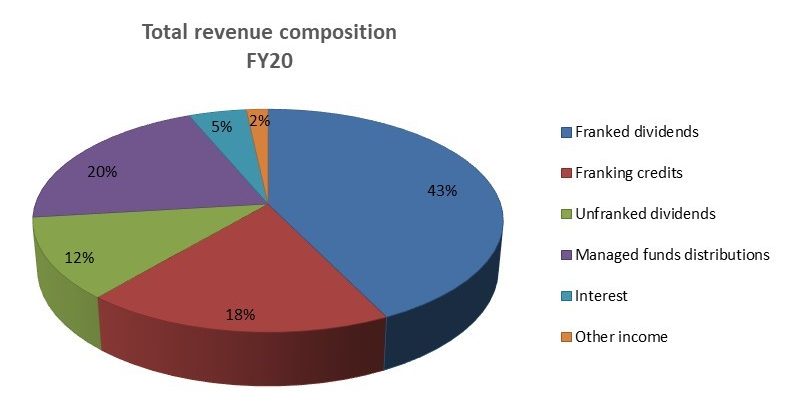

HMSTrust continues to manage internally its Australian equities portfolio on a passive basis enabling HMSTrust to take advantage of its tax-exempt status (particularly franking credits and participation in off-market shares buy-backs) and also giving us the flexibility to screen out stocks not in-line with HMSTrust’s vision, purpose and granting strategy (two stocks are currently screened out: Aristocrat Leisure and Treasury Wine Estates). The benchmark is the S&P/ASX50 Franking Credit Adjusted Daily Total Return (Tax Exempt) Index modified for those exclusions and for FY20, HMSTrust’s Australian equities portfolio outperformed the benchmark by 0.12%, mainly as result of participating in placements and the Qantas off-market share buy-back.

Asset allocation

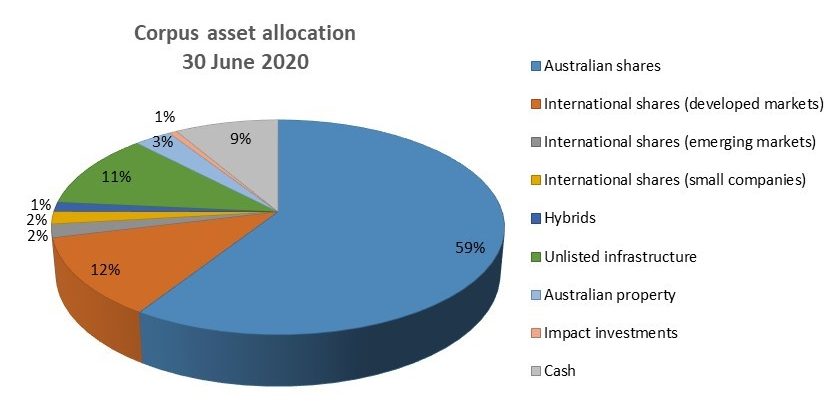

HMSTrust operates in perpetuity and this allows the corpus to have a high allocation to growth assets (84% at 30 June 2020). An allocation to developed markets small companies was included for the first time during FY20.